The growth of PC and Internet penetration in India has been impressive in the past few years. However, the bulk of this growth has mostly been in urban India thereby widening the gap between rural and urban India in terms of adoption of Information and Communication Technologies (ICT). Considering this divide, this writeup, which is primarily taken from an IMRB Survey done in 2007, examines aspects of localisation and regional content provided over the Internet. On a passing note to ratify the findings of the survey I would like to allude to another survey done by Euromonitor. The survey posited that Internet users generally prefer to read in local language had gone

up from 59% in 2007 to 72% in the year 2008.(The data is a bit old)

up from 59% in 2007 to 72% in the year 2008.(The data is a bit old)The premise this report attempts to evaluate is that the traditional media (i.e. television) adoption rates increased once the content offered was more regional in nature, a similar spurt in usage can be expected once the digital media such as the Internet provides localized and regional content.In addition to taking key conclusions from the IMRB survey, I have added some of my views and inferences which I gathered while researching on this topic.

Upon conducting primary as well as secondary research, the IMRB report arrived at the following conclusions:

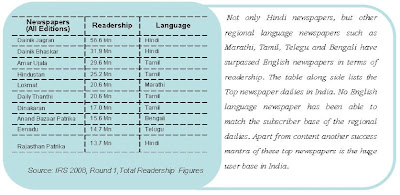

1. The characteristics and orientation of Indian populace towards consuming print, audio and visual communication is regional and localized in nature. They seem to be more amenable to communicate in the language they are more familiar with. English seems to be their less preferred choice of language.

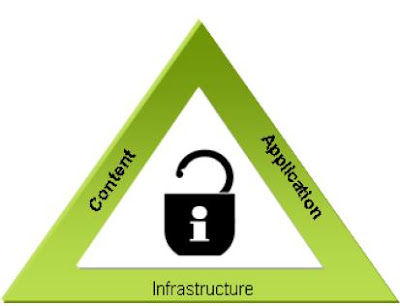

2. Following the patterns in television and radio medium, the key to unlocking the doors to widespread adoption of ICT in India lies in achieving the mix of infrastructure, application and content.

3. There is a difference in the usage as well as demand of vernacular content among the Indian populace. While the urban population is predominantly occasional user of vernacular content and indulge in local language access and exchange on a cyclical basis, the rural population uses the vernacular content very infrequently. The reason for this difference is primarily because of the non-availability of infrastructure as well as content in vernacular language.This is where I feel the next round of organic growth would happen for ecommerce. Increase in the consumption of Indic languages would bring the so called marginalized population into the realm of internet in general and ecommerce/etailing in particular. Many companies, I know of are investing in transliteration product for the web and mobile.

4. For the digital localisation or vernacular industry to take-off in a big way, there is a need for digital content that is designed to serve daily and important informational needs of rural as well as urban population. For rural areas, as an example, an apt application would be providing medical information through public access computers. Research and development efforts are also needed to provide predictive translation initiatives such as context-specific literal translation as well as advanced solutions such as Optical Character Recognition (OCR) and Text-to-Speech. Given these initiatives by the public as well as private sector, we expect that India will catch up with the highly developed localized markets across the world.

Few forms of content delivery:

Disaster blogging is an interesting facet of this vernacular adoption phenomenon that came to the fore during the time of the Chennai tsunami, Mumbai flood/rains, Mumbai blasts and the like. In addition to above, almost all the major media houses such as NDTV, CNN-IBN and Business Standard, are trying out blogging to tap stories and comments from citizens. CNN-IBN has gone ahead and announced a citizen journalist award for posting best story.

Vortals

The current bouquet of Indian language offerings is mostly news. These vortals offer news in Indian language as follows:

• International news sites offering international news in Indian language.

• Websites of traditional newspapers and news channels offering news in Indian language. The web versions of their newspapers include Indian language papers like Dainik Jagran, Navbharat Times, LokTej, etc. Their USP is in providing not only local language interface but also news at local level in addition national and international level news.

• Portals collating news from various sources like international news from Reuters, national news from PTI and publishing them in Indian language.

Content, application and infrastructure would determine how easily vernacular content would penetrate the masses. Infrastructure comprises access points, such as kiosks, public access, mobile phones and enabling devices such as keyboards and peripheral devices. These sets of infrastructure need to be in the Indian language interface so that it is easier for the users to interact with the technology in the language they are comfortable to them. To ensure an end-to-end local language delivery, Applications as well as Content need to be provisioned in localized language. Exemplar applications in ICT include facilities such as messaging, web browsing and the like. Content are sets of information that could be exchanged and accessed through these applications. The content that is available today on the Internet is largely in English and is location independent. The task is to make this content available in the dialects spoken in India. However, given the diverse socio cultural background in India this is a complicated task. Mere literal translation of the content in local language might not ensure adoption. A context-aware translation, on the other hand, is needed to guarantee widespread acceptance of ICT. Once infrastructure, application and content is available in Indian language a bulk of the population which is not literate in English would be able to relish the benefits of technology.