Globally, mobile phones have seen unabated growth over the past few years. In India, the number of mobile subscribers crossed the 300 million mark in August 2008 from just 14 million at the end of March 2003; and 8-9 million subscribers continue to be added every month. Over the next 5 years, it is expected that the mobile subscriber base to more than double and reach 638 million in March 2013.

Globally, mobile phones have seen unabated growth over the past few years. In India, the number of mobile subscribers crossed the 300 million mark in August 2008 from just 14 million at the end of March 2003; and 8-9 million subscribers continue to be added every month. Over the next 5 years, it is expected that the mobile subscriber base to more than double and reach 638 million in March 2013.Mobile phone users in India outnumber credit/debit cards and internet users 2.5 to one. The convergence of data and voice on the mobile platform has enabled the mobile phone to emerge as a convenient and secure channel for the conduct of commercial transactions. The m-commerce sector is poised for growth in the Indian market owing to its intrinsic link to the booming mobile telephony sector in the region. TRAI reported that the number of Indians who accessed the Internet or use high-end data services over the mobile increased by 8 million from Q1 ‘07 (38 million) to Q2 ‘07 (46 million). This compared to only 9.3 million total PC internet connections across India in 2007(Could not gather data for 2009). However, the use of the mobile channel for electronic transactions is still disproportionately lower than it should be, given the penetration numbers above.

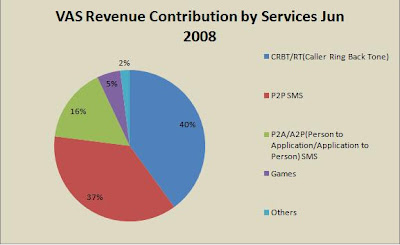

The Current Mobile VAS (Value-Added Services) industry (mCommerce is a part of it) was Rs. 9760 crores by end June 2009 and is estimated to grow steadily at 70% to touch Rs.16520 crores by end June 2010. The current MVAS market size and contribution of each of the services (that make up the MVAS domain) is given below.

The Current Mobile VAS (Value-Added Services) industry (mCommerce is a part of it) was Rs. 9760 crores by end June 2009 and is estimated to grow steadily at 70% to touch Rs.16520 crores by end June 2010. The current MVAS market size and contribution of each of the services (that make up the MVAS domain) is given below. Currently, users of m-commerce perform a wide variety of transactions via mobile from paying of utility bills and purchase of movie tickets to shopping and holidays. While the uptake of mobile payments is still gathering pace, services that are more accessible and easier to use are finding favour.

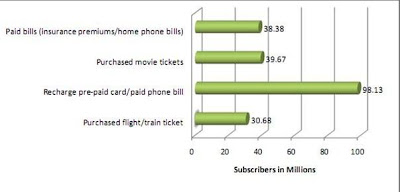

Currently, users of m-commerce perform a wide variety of transactions via mobile from paying of utility bills and purchase of movie tickets to shopping and holidays. While the uptake of mobile payments is still gathering pace, services that are more accessible and easier to use are finding favour.With the RBI’s support for m-banking and the release of its guidelines on mobile banking transactions (Sept-Oct 2008), banks have sped up their roll out of m-payment products with banks such as Standard Chartered, SBI and IDBI Bank launching their services in the early part of the year. A research done by The “Nielsen Company” shows 64 percent of m-payment users surveyed had registered for an m-commerce service within the prior six months. This points to a spike in consumer confidence in m-commerce since the RBI issued its guidelines in Sept-Oct 2008.

VAS/Internet Usage over Mobile

1. Searching for information and checking email are the main reasons why Indians use Internet on their mobile phones.

2. Google and Yahoo continue their dominance of the Indian mobile screen.

VAS/mCommerce

mCommerce is at a very nascent stage in India and the bouquet of services is yet to evolve. Currently, services such as purchase of movie tickets, information on bank account, transfer of funds, bill payments and merchant payments are the key offerings through the mobile platform. The financial services sector has been one of the early adopters of mCommerce due to the standardised and undifferentiated nature of products. Most of the large banks in India have started using the mobile phone as a channel to offer services to their customers. Retail is another sector that offers mCommerce services by allowing the customers to place orders and purchase products on-the-move.

Recharging pre-paid card or paying monthly phone bill is the most popular m-commerce activity undertaken by urban Indians.

Internet (on mobile) and mCommerce usage clearly shows that very few Indians have purchased retail items on the internet.

WEBZIN INFOTECH provides an excellent reliable web designing services at affordable prices.

ReplyDeleteWebzin Infotech